Credit risk performance update - October 2020

Today we published our Q3 2020 performance update on our statistics page. This update comes as we continue to observe high economic uncertainty as the unprecedented nature of the COVID-19 outbreak continues to impact how we live and work, as well as another potential risk resurfacing via the ongoing Brexit negotiations. We have observed high street banks and other UK lenders taking enormous provisions against loan losses, and the upside scenario published by the Office for Budget Responsibility unemployment rate peaks at 9.7% this year, and it does not return to pre-crisis levels until 2022.

To protect the investments made by retail investors, during Q3 2020, we continued to support loan customers who have seen their financial circumstances being impacted by the Covid-19 outbreak and prepared our strategies to resume new lending.

At the end of September 2020, approximately 90% of customers exiting their payment deferral period have resumed their regular monthly payments which are positive and in line with the average across the industry.

However, approximately 2% of our loan book was still on a payment deferral hence there remains uncertainty on those customers ability to resume their regular monthly payments.

Furthermore, we have observed performance deterioration within the group of customers that started to miss their loan repayments but did not engage with our collections team and did not request a payment deferral. We believe many of these customers will go on to default on their loans.

As a result, our latest assessment of expected unrealised bad debt for the remaining term of active loans has increased by approximately 30%. We will be required to adjust lender rates further using the existing Lender Rate Adjustment mechanism, resulting in a period of negative interest rates to divert more funding to the Shield to cover the loan defaults that we expect to occur in the coming months.

Whilst a period of negative interest rates is needed, the expected annual returns received by every retail investor over the lifetime of their investment is expected to remain positive, i.e. despite the COVID-19 crisis we still expect no capital losses. To account for the impact of COVID-19, the period of negative interest rates will be phased, being more severe for 3 months, then easing after that.

Expected annual retail investor returns have decreased, compared to our Q2 2020 update. Average returns on past cohorts (2014-2019) have reduced from 4.6% to 4.2% p.a. for Growth investments and from 3.8% to 3.6% p.a. for Flexible. Average returns on the 2020 cohort have decreased from 4.2% to 3.6% p.a. for Growth and from 3.0% to 2.6% p.a. for Flexible.

The impact of Covid-19 on portfolio performance

In Q3 2020, we continued to observe high economic uncertainty as the unprecedented nature of the COVID-19 outbreak continues to impact how we live and work.

Regulatory environment

The Financial Conduct Authority (FCA) has continued to focus on promoting measures to support UK consumers who may have been impacted by COVID-19. On 30 September 2020, the FCA published guidance on how lenders should help customers coming to the end of their payment deferrals or customers who may be newly impacted by COVID-19 after 31 October.

We fully aligned our collections and recoveries policy to the latest FCA guidance, and we will be fully supporting customers who may continue to face financial difficulties. Having the best interests of our customers in mind will remain a top priority for us as the full impact of the COVID-19 crisis continues to unfold.

How COVID-19 has so far impacted our borrowers

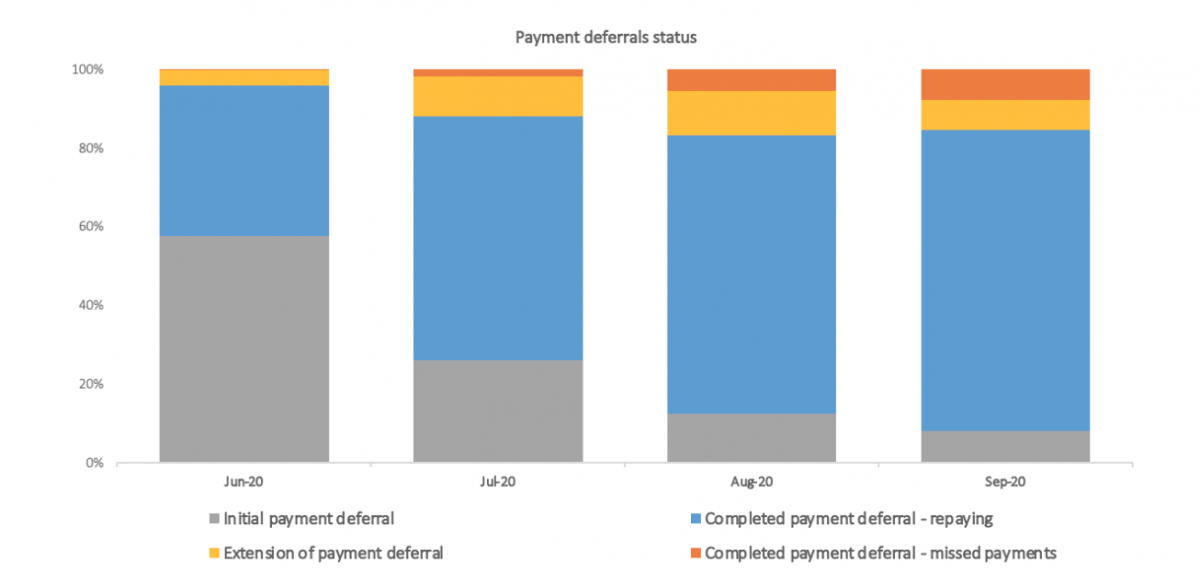

To date, we have supported more than 1,500 loan customers with payment deferrals, and at the end of September only approximately 250 were still active - either on their first payment deferral or on an extension, which accounts for approximately 2% of our active loan book.

We have seen a significant decrease in the volume of newly granted payment deferrals which reduced from an average of approximately 25 per day in April to approximately 2 per day in September. We are also pleased to report that the vast majority of our loan customers have resumed their repayments at the end of the payment deferral period.

At the end of September, approximately 90% of customers exiting their payment deferral period have resumed their regular monthly payments.

We regularly benchmark our credit performance figures with all major UK lenders, and ours are in line with the average across the industry, which gives us confidence that our portfolio will perform broadly in line with the high street banks and other significant lenders in the market.

We are confident that out of the remaining 2% of customers who are still on an active payment deferral, the majority of them will also resume their monthly repayments at the end of the payment deferral period.

However, approximately 9% of customers that took a payment deferral have not been able to resume their regular monthly repayments. Those loan customers are receiving tailored support from our collections team to help them to make affordable payments against their loan.

As well as the customers that took a payment deferral, there is another group of customers (approximately 2% of our loan customers) that started to miss their loan repayments but did not engage with our collections team and did not request a payment deferral. The repayment performance within this group has been significantly worse, and we believe many of these customers will go on to default on their loans.

How we expect COVID-19 to impact long-term portfolio performance

Most economists forecast the potential economic impact of both COVID-19 and the ongoing Brexit negotiations to continue for at least another 12 months. On this basis, we will continue to closely monitor the portfolio performance as we recognise that an increased number of our loan customers may fall into financial distress, particularly when the current furlough scheme ends at the end of October and the Governments new Job Support Scheme ends in April 2021.

Our collections and recoveries capabilities have been strengthened, and in Q2 2020 we have further invested in new technology to help reduce the impact of COVID-19 on our portfolio and consequently investor returns. Unfortunately, though, some loan customers will face long term financial difficulties, which will therefore have an impact on our portfolio performance and expected credit losses.

Our stress testing framework uses publicly available information to define the peak point in the consumer credit cycle, and the long-running average represents the Through The Cycle (TTC), or average level of consumer insolvencies. Using this framework, we have stressed our loan portfolio to understand the potential increase in credit losses and concluded that annual loss rates could increase by c.15%, compared to our baseline scenario.

We are aware that the full impact of COVID-19 on the UK economy and our loan portfolio remains uncertain at this stage, and we will continue to monitor portfolio performance closely.

Expected annual returns

We have today updated our performance statisticswhich can be summarised as follows:

- Expected annual returns have further reduced as we expect higher annual loss rates on the active portfolio, driven mainly by the impact of the COVID-19 outbreak.

- Expected annual loss rates have increased since our Q2 2020 update, mainly driven by the most recent performance of the portfolio and the current macroeconomic conditions.

- Expected annual losses have been updated to reflect the most recent portfolio performance as well as our stress test scenario as we continue to understand the impact of COVID-19 on the economy, UK consumers and our loan customers.

Overall expected annual losses on the active portfolio increased from 3.8% in Q2 2020 to 4.4% in our Q3 2020 update. We anticipate a further increase in loss rates in the short-medium term as some loan customers will fall into financial distress when the furlough scheme ends.

Expected annual returns have reduced since our Q2 2020 update but remain positive for all investors and all cohorts. Expected annual returns reduced in line with an increase in expected annual loss rates hence requiring us to divert further funds to the Lending Works Shield under our Lender Rate Adjustment Mechanism.

The changes we made in late 2019 have resulted in a more resilient Lending Works Shield. While we could not have anticipated that there would be a global pandemic, we continue to believe that the ability to use variable interest rates to account for variations in the performance of the portfolio performance protects investors and the stability of returns over the lifetime of their investments.

Due to the current economic environment, we will use the Lender Rate Adjustment Mechanism to apply a period of negative interest rates which will divert more funding to the Lending Works Shield as the full impacts of COVID-19 in our portfolio are felt. While interest rates are negative, the monthly repayments made to retail investors will decrease further with the reduction being entirely diverted to the Lending Works Shield.

Whilst a period of negative interest rates is needed, the expected annual returns received by every retail investor over the lifetime of their investment is expected to remain positive, i.e. despite the COVID-19 crisis we still expect no capital losses. To account for the impact of COVID-19, the period of negative interest rates will be phased, being more severe for a period of 3 months, then easing after that.

Expected annual retail investor returns have decreased, compared to our Q2 2020 update. Average returns on past cohorts (2014-2019) have reduced from 4.6% to 4.2% p.a. for Growth investments and from 3.8% to 3.6% p.a. for Flexible. Average returns on the 2020 cohort have decreased from 4.2% to 3.6% p.a. for Growth and from 3.0% to 2.6% p.a. for Flexible.

Recent cohorts are the most affected, whereas older cohorts, where the majority of the loan balances have already been repaid, are less affected.

The Lending Works Shield

Since the beginning of the COVID-19 outbreak, we have observed an increase in the percentage of loans which have one or more missed payments, compared to the beginning of 2020 which has been exacerbated as payment deferrals come to an end. Some customers are unable to resume their regular monthly repayments.

The Shield future income required to cover expected losses, increased to £8.9m, compared to £8.0m in Q2 2020. It reflects the most recent performance of the portfolio, primarily driven by 2017-2019 cohorts, and our stress scenario of expected credit losses in our portfolio as a direct impact of COVID-19.

The Shield cash balance increased from £0.5m in Q2 2020 to £1.3m in Q3 2020 mainly driven by three factors:

- We sold a portfolio of defaulted loans to a debt purchase firm for proceeds of £0.4m;

- Shield utilisation has been managed carefully as we anticipate a potential increase in arrears payments at the end of the payment deferral period; and

- Shield utilisation remains low on the 2020 cohort, and £0.5m of the total balance is associated with this cohort.

While the cash balance of the Shield has increased, we want to highlight that our forecast of defaults that will occur over the next few months will consume the majority of that increase.

The way the Lending Works Shield operates means that there is no contagion risk between cohorts, i.e. the contingency fund cash balance associated with 2020 loans will only be used to make repayments to relevant retail investors holding 2020 loans, and the utilisation of the Shield for 2020 loans remains in line with expectations.

We expect to apply negative interest rates to all 2014-2019 cohorts in the short-term. However, portfolio performance will continue to be closely monitored, and the Lender Rate Adjustment mechanism will be used to ensure the Lending Works Shield adequately covers expected losses at each given point.

Resume new lending

We hope to announce that we will be resuming new lending shortly, after pausing since March 2020. As a responsible lender, we will resume new lending with a tightened creditworthiness and affordability criteria to reduce both affordability risk for borrowers and credit losses to Lending Works. We have already made changes to our minimum lending criteria and borrower risk profile to account for the current economic conditions.

Lending policies and borrower risk profile

We have tightened our lending policies to reduce exposure to borrower segments which may be more vulnerable during the COVID-19 pandemic. We have also tightened our lending criteria to reduce exposure to less creditworthy borrowers, based on our internal risk categories.

Income verification and affordability assessment

We have implemented more stringent income verification and affordability rules as COVID-19 introduces further challenges in assessing borrowers' ever-changing financial circumstances.

We will also further promote the use of Open Banking so we can better assist borrowers when assessing their ability to make sustainable repayments.

For more information about our credit underwriting framework, please see our Risk Management Framework.

Furthermore, we will ensure that loans are priced appropriately so that contributions from new loans into the Lending Works Shield are suitable for the current uncertain economic environment.

Debt sale

Inevitably, sometimes we exhaust our recoveries strategies from both our in-house team and our debt collection partners, and we are unable to increase recoveries on defaulted loans any further. Therefore, the best outcome is often to work with an FCA-regulated debt purchasing company to purchase those defaulted loans.

In September 2020, we completed a sale of a batch of defaulted loans which resulted in £0.41m being added into the Lending Works Shield. The total proceeds from the debt sale were transferred to the Shield - Lending Works does not receive any of the proceeds.

We have now partnered with two different FCA-regulated debt purchasing companies so we can complete debt sales regularly in the future, which will allow us to boost the contingency fund cash balance regularly.

Next update

Our next statistics page update will be in January 2021, and it will continue to be focused on the impact COVID-19 is having on Lending Works' portfolio performance.