Credit risk performance update - June 2021

Today we published our Q1 2021 performance update on our statistics page.

Expected annual returns

Both expected annual returns and expected annual loss rates have remained relatively stable compared to our Q1 2021 update.

Expected annual losses have been updated to reflect the most recent portfolio performance and the results of our stress testing. We continue to monitor the full impact of COVID-19 on the economy, UK consumers and our loan customers.

Overall expected annual losses on the active portfolio have slightly improved from 4.5% annualised in Q1 2021 to 4.3% annualised in Q2 2021. However, we anticipate a further increase in loss rates in the short-medium term as some of our existing loan customers may fall into financial distress when their payment deferral period ends, and the Government-backed schemes also come to an end.

Expected annual returns have remained relatively stable and are broadly in line with the Q1 2021 performance update forecast.

Average returns on older cohorts (2014-2019) are 4.3% p.a. for Growth investments and 3.7% p.a. for Flexible. The 2020 and 2021 cohorts' average returns are 2.8% and 4.5% p.a. for Growth and 2.0% and 4.0%p.a. for Flexible, respectively.

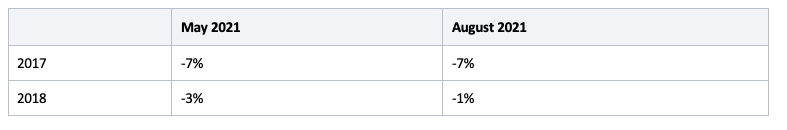

Due to the current economic environment, negative interest rates are still required for two annual cohorts, 2017 and 2018. Interest rates diversion will continue to be applied to 2016 and earlier, whereas the 2020 and 2021 cohorts will continue to pay interest as per the original target.

That said, we are pleased to inform you that the negative interest adjustments will also reduce for the 2018 cohort as per below:

The Lending Works Shield

The future income required to cover expected losses decreased to £3.6m, compared to £5.0m in Q1 2021. This is driven by loans that defaulted during Q2 2021, where the Lending Works Shield made the repayments to the relevant investors.

The £3.6m reflects the most recent performance of the portfolio and results of our stress testing of expected credit losses in our portfolio as a direct impact of COVID-19.

The Shield cash balance decreased from £0.98m in Q1 2021 to £0.74m in Q2 2021. Shield utilisation was high still in Q2 2021 as many loans defaulted during that period. However, the 2020 cohort accounts for approximately £0.43m of £0.74m, which has not been utilised yet.

We expect the cash balance of the Shield for the 2014-2019 cohorts utilisation to be maximised as the expected level of defaults is aligned to the expected Shield cash inflows in the short-medium term and ahead of a potential deterioration in Q4 2021.

Next update

Our next statistics page update will be in October 2021.