Credit risk performance update - December 2020

Today we published our Q4 2020 performance update on our statistics page. This update comes as we continue to observe high economic uncertainty due to the COVID-19 outbreak.

In Q4 2020, we continued our journey in supporting loan customers who have seen their financial circumstances being impacted by the COVID-19 outbreak, which in turn helps to improve future recoveries for investors.

At the end of 2020, approximately 85% of customers exiting their payment deferral period have resumed their regular monthly payments, which is in line with the industry average. Approximately 1% of our loan book is still on a payment deferral, hence there remains some uncertainty on those customers' ability to resume their regular monthly payments.

Both expected annual returns and expected annual loss rates have remained relatively stable, compared to our Q3 2020 update.

A period of negative interest rates is still required, but the severity of the negative interest rates will ease from February 2021 onwards as predicted in our Q3 2020 update. However, we will continue to closely monitor the portfolio performance as we recognise that an increased number of our loan customers may fall into financial distress, particularly when the Government-backed support schemes come to an end.

Expected annual retail investor returns have remained relatively stable, compared to our Q3 2020 update. Average returns on past cohorts (2014-2019) have reduced from 4.2% to 4.1% p.a. for Growth investments and remained at 3.6% p.a. for Flexible. The 2020 cohort's average returns have decreased from 3.6% to 3.1% p.a. for Growth and from 2.6% to 2.1% p.a. for Flexible.

The impact of Covid-19 on portfolio performance

Regulatory environment

The Financial Conduct Authority (FCA) has continued to focus on promoting measures to support UK consumers who may have been impacted by COVID-19. On 19 November 2020, the FCA published further guidance on how lenders should help customers who are still facing financial difficulties or may have been newly impacted by COVID-19 after 31 October.

Payment deferrals have been extended into 2021 with a maximum of 6 months being given to customers; hence the full impact of COVID-19 in our portfolio will continue to unfold in 2021. Where investors hold loans subject to a payment deferral, scheduled payments will be deferred and will resume on the date specified in your loan book download.

As always, we fully aligned our collections and recoveries policy to the latest FCA guidance, and we will be fully supporting customers who may continue to face financial difficulties. Having the best interests of our customers in mind continues to be a top priority for us as the full impact of the COVID-19 crisis continues to unfold.

How COVID-19 has so far impacted our borrowers

At the end of 2020, approximately 170 loan customers were on an active payment deferral - either on their first payment deferral or on an extension, which accounts for approximately 1% of our active loan book.

At the end of December 2020, approximately 85% of customers exiting their payment deferral period have resumed their regular monthly payments.

However, approximately 15% of customers who took a payment deferral have not resumed their regular monthly repayments. This has deteriorated compared to our Q3 2020 update, as loan customers who requested 6-month payment deferrals are less likely to resume their payments at the end of that period. Those loan customers receive tailored support from our collections team to help them make affordable payments against their loan.

As per our Q3 2020 update, as well as the customers that took a payment deferral, there is another group of customers (approximately 2% of our loan customers) that started to miss their loan repayments but did not engage with our collections team and did not request a payment deferral. The repayment performance within this group has been significantly worse, and we believe many of these customers will go on to default on their loans.

How we expect COVID-19 to impact long-term portfolio performance

We expect that the full potential economic impact of COVID-19 will continue to unfold on the UK economy and in our portfolio throughout 2021. On this basis, we will continue to closely monitor the portfolio performance as we recognise that an increased number of our loan customers may fall into financial distress, particularly when the Government-backed support schemes come to an end.

Our collections and recoveries capabilities have been strengthened throughout 2020 to support customers who may have been adversely impacted by the COVID-19 pandemic.

Our stress testing framework uses publicly available information to define the peak point in the consumer credit cycle. The long-running average represents the Through The Cycle (TTC), or average level of consumer insolvencies. Using this framework, we have stressed our loan portfolio to understand the potential increase in credit losses and our latest view is reflected in this Q4 2020 update.

However, we are aware that the full impact of COVID-19 on the UK economy and our loan portfolio remains uncertain at this stage. We will continue to monitor portfolio performance closely.

Expected annual returns

We have today updated our performance statistics which can be summarised as follows:

Both expected annual returns and expected annual loss rates have remained relatively stable, compared to our Q3 2020 update.

Expected annual losses have been updated to reflect the most recent portfolio performance and our stress test scenario as we continue to understand the impact of COVID-19 on the economy, UK consumers and our loan customers.

Overall expected annual losses on the active portfolio remain at 4.4% in Q4 2020. However, we anticipate a further increase in loss rates may happen in the short-medium term. Some loan customers will fall into financial distress when their payment deferral comes to, and the Government-backed schemes also come to an end.

Expected annual returns have remained fairly stable and are broadly in line with the forecast from the Q3 performance update.

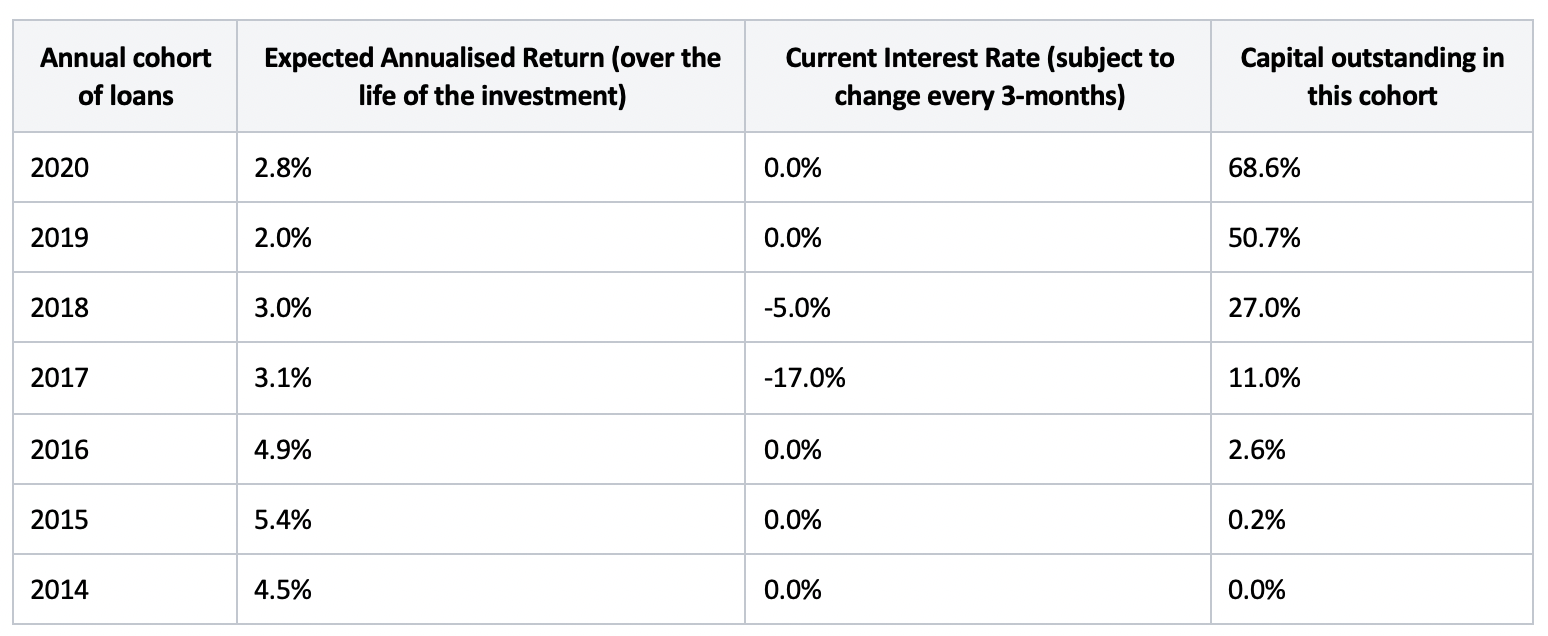

However, due to the current economic environment, the negative interest rates are still required for two of the annual cohorts, 2017 and 2018. This analysis will be repeated every three months and published in the quarterly performance update, therefore interest rates will remain subject to change, however, we forecast that the Current Interest Rates shown in the table below will be maintained for the foreseeable future.

Of the total amount of negative interest we expect the Lending Works Shield to need to cover expected losses, 56% has now already been diverted to the Shield and the remaining 44% will be diverted as per the table below, over the rest of the life of those loans.

The Lending Works Shield

As the impacts of COVID-19 unfold, we continue to observe an increase in the percentage of loans with one or more missed payments, exacerbated as payment deferrals come to an end. Some customers are unable to resume their regular monthly repayments.

The future income required to cover expected losses decreased to £7.2m, compared to £8.9m in Q3 2020 as many loans defaulted in Q4 2020 and the Lending Works Shield made the repayments to the relevant investors.

The £7.2m reflects the most recent performance of the portfolio and our stress scenario of expected credit losses in our portfolio as a direct impact of COVID-19.

The Shield cash balance decreased from £1.3m in Q3 2020 to £0.9m in Q4 2020. Shield utilisation was high in Q4 2020 as many loans defaulted during that period.

We expect the cash balance of the Shield to decrease in the coming months, as the expected level of defaults that will occur over the next few months will continue to utilise the cash balance month-on-month.

As outlined above, we expect to apply negative interest rates to 2017 and 2018 cohorts for the foreseeable future. However, as per our Q3 2020 update, the negative interest rates will be significantly reduced for the remainder of the loan terms.

Resume new lending

We resumed new lending at the start of January 2021, with tightened creditworthiness and affordability criteria to reduce both affordability risk for borrowers and credit losses for investors.

As per our Q3 2020 update, we changed our minimum lending criteria and borrower risk profile to account for the current economic conditions.

Lending policies and borrower risk profile

We tightened our lending policies to reduce exposure to borrower segments which may be more vulnerable during the COVID-19 pandemic. We have also tightened our lending criteria to reduce exposure to less creditworthy borrowers, based on our internal risk categories.

Income verification and affordability assessment

We implemented more stringent income verification and affordability rules as COVID-19 introduces further challenges in assessing borrowers' ever-changing financial circumstances.

We also further promote Open Banking to assist borrowers better when assessing their ability to make sustainable repayments.

For more information about our credit underwriting framework, please see our Risk Management Framework.

Furthermore, we ensure that loans are priced appropriately so that contributions from new loans into the Lending Works Shield are suitable for the current uncertain economic environment.

Next update

Our next statistics page update will be in April 2021, and it will continue to be focused on the impact COVID-19 is having on Lending Works' portfolio performance.