Credit risk performance update - July 2023

We are pleased to publish our Q2 2023 performance update on our statistics page.

In Q2 2023, we continued to focus on the broader macroeconomic conditions and the impact they may have on our active loan customers. We also continue to enhance our processes and procedures to support borrower customers who may face changes in their financial circumstances.

Both expected annual returns and loss rates have remained relatively stable compared to our Q1 2023 update.

Finally, based on the most recent portfolio performance, we will continue to pay at the target interest rate level for all cohorts.

Expected annual returns

Both expected annual returns and loss rates have remained broadly stable compared to our Q1 2023 update.

Expected annual losses have been updated to reflect the most recent portfolio performance based on the latest quarter.

Overall expected annual losses on the active portfolio have slightly increased from 3.7% in Q1 2023 to 4.1% in Q2 2023, and we will continue to monitor it closely due to the external economic environment.

Expected annual returns have remained relatively stable and broadly aligned with the previous performance update.

Average returns on past cohorts (2014-2019) are 4.4% p.a. for Growth investments and 3.8% p.a. for Flexible; this continues to be maintained from the previous update.

The 2020 and 2021 cohorts' average returns are 2.5% p.a. and 4.5% p.a. for Growth and 1.8% and 4.0%p.a. for Flexible, respectively, maintained from the previous update.

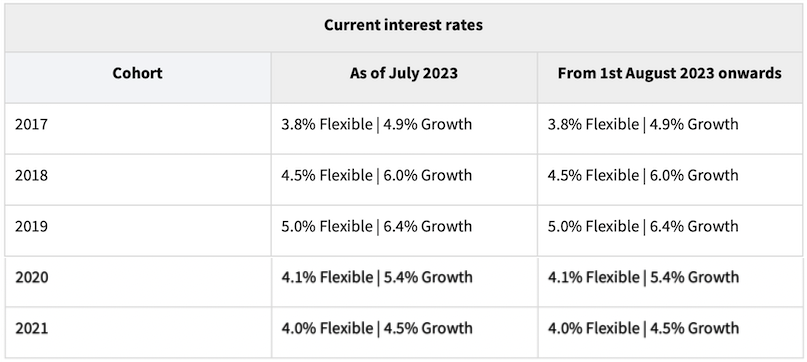

We will continue to pay at the target interest rate level for all cohorts as per the below table:

The Lending Works Shield

The Shield cash balance remained relatively stable at £1.1m compared to the Q1 2023 update. Shield cash utilisation continues to be maximised to pay arrears and default to retail investors while accounting for future unrealised losses.

Next update

Our next statistics page update will be in October 2023.