Credit risk performance update - March 2021

Today we published our Q1 2021 performance update on our statistics page. and this blog piece is also our Outcome Statement for 2020.

In Q1 2021, we continued our journey in supporting loan customers who have seen their financial circumstances being impacted by the COVID-19 pandemic. We also prudently resumed new lending during this quarter and reopened the secondary market to our retail investors.

Both expected annual returns and expected annual loss rates have remained stable, compared to our Q4 2020 update.

Average returns on past cohorts (2014-2019) are 4.2% p.a. for Growth investments and 3.7% p.a. for Flexible. The 2020 cohort's average returns have also remained stable at 3.0% p.a. for Growth and 2.0% p.a. for Flexible.

The impact of Covid-19 on portfolio performance

Regulatory environment

During Q1 2021, our collections and recoveries policies remained fully aligned to the latest FCA guidance. We will continue to fully support customers who may continue to face financial difficulties in the upcoming months. Having the best interests of our customers in mind continues to be a top priority for us as the full impact of the COVID-19 crisis continues to unfold.

How COVID-19 has so far impacted our borrowers

At the end of March 2021, approximately 100 loan customers were on an active payment deferral - either on their first payment deferral or on an extension, which accounts for less than 1% of our active loan book.

There remains a minor proportion of customers who can request an extension of their payment deferral until 6 months, but volumes are minimal.

We are also pleased that the overall performance of loan customers who have had a payment deferral has remained relatively stable quarter on quarter. At the end of March 2021, approximately 83% of customers exiting their payment deferral period have resumed their regular monthly payments, compared to 85% at the end of December 2020.

However, approximately 17% of customers who took a payment deferral have not resumed their regular monthly repayments. Those loan customers receive tailored support from our collections team to help them make affordable payments against their loan during this difficult time.

As per previous updates, there is another subset of customers that started to miss their loan repayments but did not engage with our collections team and did not request a payment deferral. The repayment performance within this group has been significantly worse, and we believe many of these customers will eventually default on their loans. Furthermore, we may see more customers fall into this group towards the end of the year as the Government-backed support schemes come to an end.

Expected annual returns

We have today updated our performance statistics which can be summarised as follows:

Both expected annual returns and expected annual loss rates have remained stable, compared to our Q4 2020 update.

Expected annual losses have been updated to reflect the most recent portfolio performance and the results of our stress testing. We continue to understand the impact of COVID-19 on the economy, UK consumers and our loan customers.

Overall expected annual losses on the active portfolio remain stable at 4.5% in Q1 2021. However, we anticipate a further increase in loss rates in the short-medium term. Some loan customers will fall into financial distress when their payment deferral period ends, and the Government-backed schemes also come to an end.

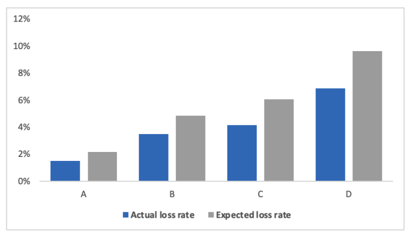

Figure 1 below shows our latest expected annual loss rate, by risk category, compared to the actual loss rate incurred to date.

The expected annual loss rate is calculated based on the actual realised bad debt to date, and our latest assessment of expected unrealised bad debt for the remaining term of active loans, including both actual and future expected recoveries.

The expected annual loss rate is revised on a quarterly basis to reflect the most recent performance of the portfolio and macroeconomic conditions.

Figure 1 - Annual loss rate by risk category

Expected annual returns have remained fairly stable and are broadly in line with the forecast from the Q4 performance update.

Expected annual retail investor returns have remained relatively stable, compared to our Q4 2020 update. Average returns on past cohorts (2014-2019) remained relatively stable at 4.2% p.a. for Growth investments and 3.7% p.a. for Flexible. The 2020 cohort's average returns have also remained relatively stable at 3.0% p.a. for Growth and 2.0% p.a. for Flexible.

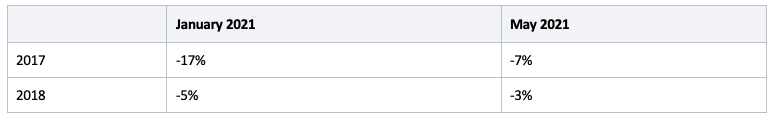

Due to the current economic environment, negative interest rates are still required for two annual cohorts, 2017 and 2018, and interest rates diversion will continue to be applied to all but 2020 and 2021 cohorts. For 2020 loans, there will not be any interest adjustments and interest will begin being paid again.

However, we are pleased to inform you that the negative interest adjustments will reduce as per below:

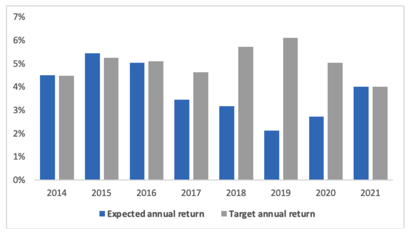

Finally, figure 2 below shows our latest expected annual return, by year of origination, compared to the target annual return when the investment was made.

Whilst 2017-2020 cohorts have seen a decrease compared to their target annual return, returns remain positive at approximately 3% p.a. on average for these cohorts.

Figure 2 - Annual return by year of origination

The Lending Works Shield

As the full impacts of COVID-19 unfold, we continue to observe an increase in the percentage of loans with one or more missed payments, exacerbated as payment deferrals come to an end. Some customers are unable to resume their regular monthly repayments, as described above.

The future income required to cover expected losses decreased to £5.0m, compared to £7.2m in Q4 2020. This is driven by two main factors: a) loans that defaulted during Q1 2021, where the Lending Works Shield made the repayments to the relevant investors; and b) we completed a debt sale in Q1-21, which also boosted the Lending Works Shield cash balance moving into Q2 2021.

The £5.0m reflects the most recent performance of the portfolio and results of our stress testing of expected credit losses in our portfolio as a direct impact of COVID-19.

The Shield cash balance increased from £0.90m in Q4 2020 to £0.98m in Q1 2021. Shield utilisation was very high in Q1 2021 as many loans defaulted during that period. Still, a combination of £0.56m proceeds from the debt sale at the end of the quarter and approximately £0.4m from the 2020 cohort, which has not been utilised yet, resulted in a stable quarter on quarter position.

We expect the cash balance of the Shield to decrease in the coming months, as the expected level of defaults that will occur over the next few months is expected to exceed the projected cash inflows, particularly for the 2014-2019 cohorts.

Debt sale

In March 2021, we completed a sale of a batch of defaulted loans, which resulted in £0.56m being added into the Lending Works Shield. The total proceeds from the debt sale were transferred to the Shield - Lending Works does not receive any proceeds.

We have now partnered with two different FCA-regulated debt purchasing companies to regularly complete debt sales in the future, allowing us to boost the contingency fund cash balance regularly.

Next update

Our next statistics page update will be in July 2021, and it will continue to be focused on the impact COVID-19 is having on Lending Works' portfolio performance.