Credit risk performance update - October 2021

Today we published our Q3 2021 performance update on our statistics page.

Expected annual returns

Both expected annual returns and expected annual loss rates have remained relatively stable compared to our Q2 2021 update.

Expected annual losses have been updated to reflect the most recent portfolio performance as we continue to closely monitor the full impact of COVID-19 on our loan customers, particularly as the Coronavirus Job Retention Scheme comes to an end.

Overall expected annual loss has remained relatively stable at approximately 4.3%. However, we anticipate that some of our existing loan customers may enter into financial distress during Q4 2021 as the government support schemes end.

However, our collections and recoveries capabilities have been strengthened over the past 18 months to help minimise the impact of COVID-19 on investor returns.

Expected annual returns have remained relatively stable and are broadly in line with the previous performance update forecast.

The average expected annual return on older cohorts (2014-2019) has remained stable at approximately 4.3% p.a. for Growth investments and 3.7% p.a. for Flexible.

The 2020 and 2021 cohorts' average returns are 2.7% and 4.5% p.a. for Growth and 1.9% and 4.0%p.a. for Flexible, respectively, which is also broadly in line with the Q2 2021 performance update.

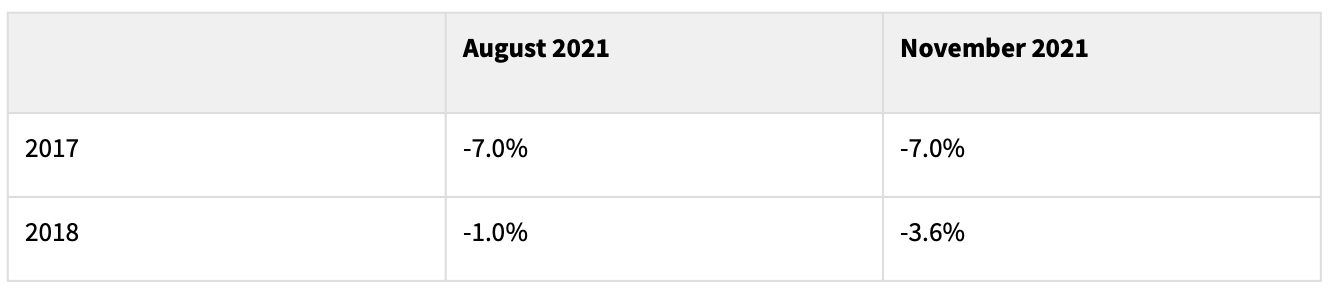

Negative interest rates are still required for the 2017 and 2018 cohorts to ensure that the Lending Works Shield appropriately covers expected unrealised bad debt in the active portfolio. Interest rate diversions to the Shield will continue to be applied to 2016 and earlier, whereas the 2020 and 2021 cohorts will continue to pay the original target rate of interest.

The negative interest adjustments will be updated as per the below for the 2017 and 2018 cohort as per below:

We believe prudence continues to be sensible as the government support programs are wound up. That said, if the measures we have taken are overly prudent, the Lender Rate Adjustment mechanism will be used to increase expected annual returns received by investors over the lifetime of the loans in their portfolio.

The Lending Works Shield

The future income required to cover expected losses decreased to £3.4m, compared to £3.6m in Q2 2021. The £3.4m reflects the most recent performance of the portfolio and our latest assessment of the expected credit losses in our portfolio as a direct impact of COVID-19.

The Shield cash balance decreased from £0.74m in Q2 2021 to £0.63m in Q3 2021. Shield utilisation has been mainly driven by arrears and default payments to retail investors to older cohorts loans.

We expect the cash balance of the Shield for the 2014-2019 cohorts utilisation to continue to be maximised as the expected level of defaults is aligned to the expected Shield cash inflows.

Next update

Our next statistics page update will be in January 2022.